We at ch-aviation keep track of all aircraft deliveries in real-time. This week, we ran a 2022 aircraft deliveries “Airbus vs Boeing” report and here are some interesting insights:

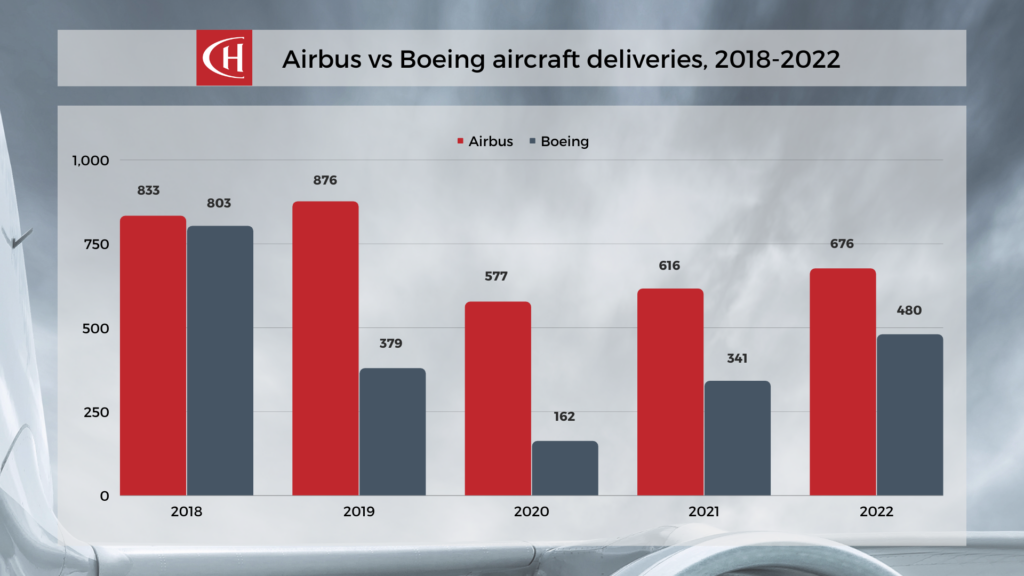

Airbus has led in aircraft deliveries for the past four years, with the most substantial difference in 2019 due to the B737 MAX grounding. Covid-19 hit both manufacturers equally in 2020. In total, Airbus delivered 676 aircraft in 2022, while Boeing delivered 480. That now slowly closes the gap from a close tie in 2018 to Boeing being approximately 29% behind in deliveries compared to Airbus in 2022, recovering from a 47% gap in 2021 and a whopping 72% in 2020. It seems like things are moving in the right direction for Boeing.

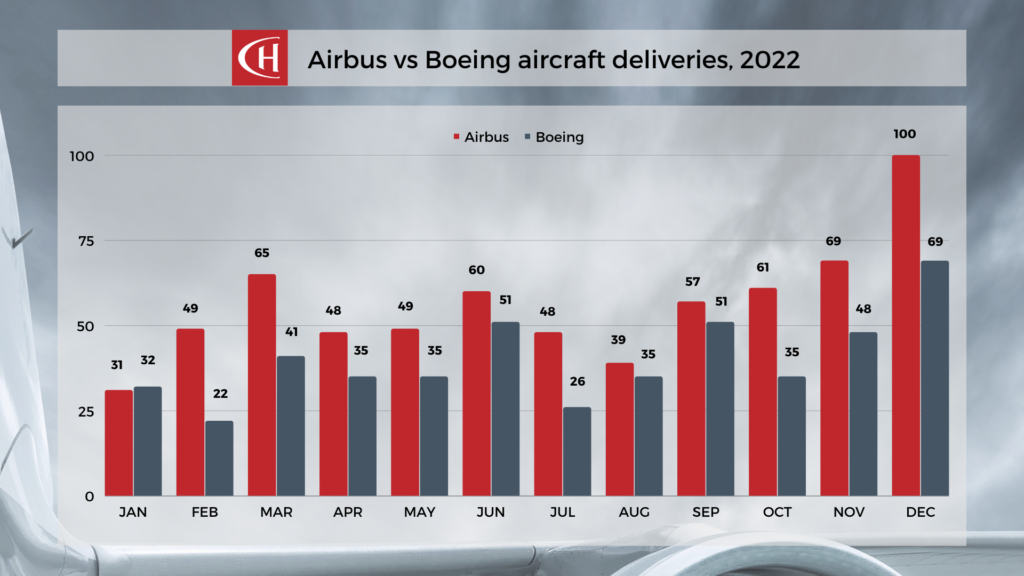

December 2022 had the most aircraft deliveries for Airbus and Boeing, with 168 delivered – 100 by Airbus and 69 by Boeing. When comparing monthly deliveries, we can see that Airbus prevailed every month except for January. However, Boeing only had one more delivery than Airbus in January 2022, totalling 32 aircraft.

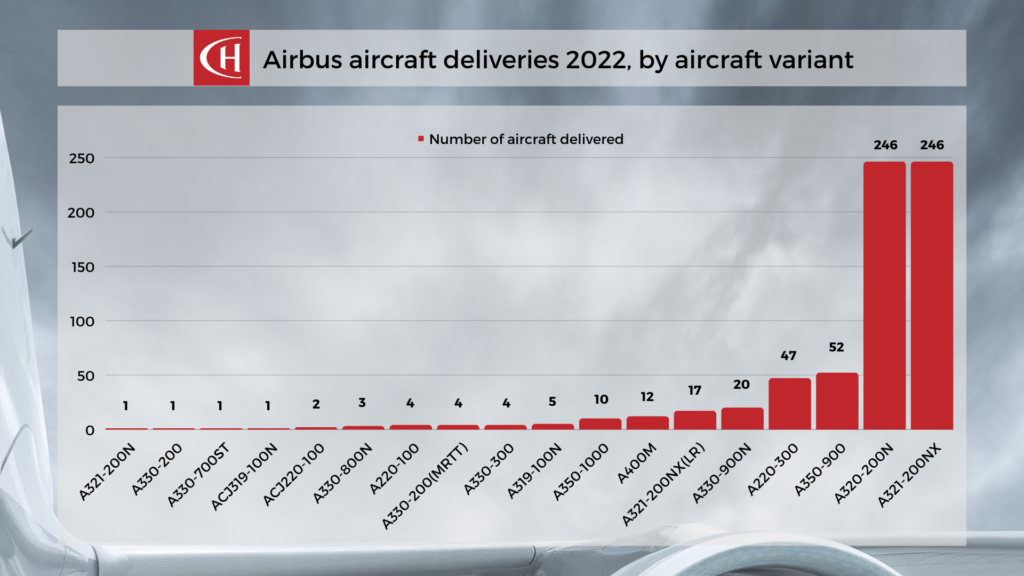

When analysing Airbus aircraft deliveries by aircraft variant, the most delivered aircraft variants in 2022 were the A320-200N and A321-200NX, with 246 of each. Looking at this from a production line perspective, the output translates to 41 aircraft per month for the A320 family. Initial expectations of delivering 50 A320 family aircraft per month were short by 18%.

The A220 production line is a great addition to the Airbus portfolio, performing strongly with a total of 52 deliveries across both variants. Unsurprisingly, A319 deliveries are pretty low, with five deliveries across the different variants. The A319 could be the next A320 family member after the A318 go out of production.

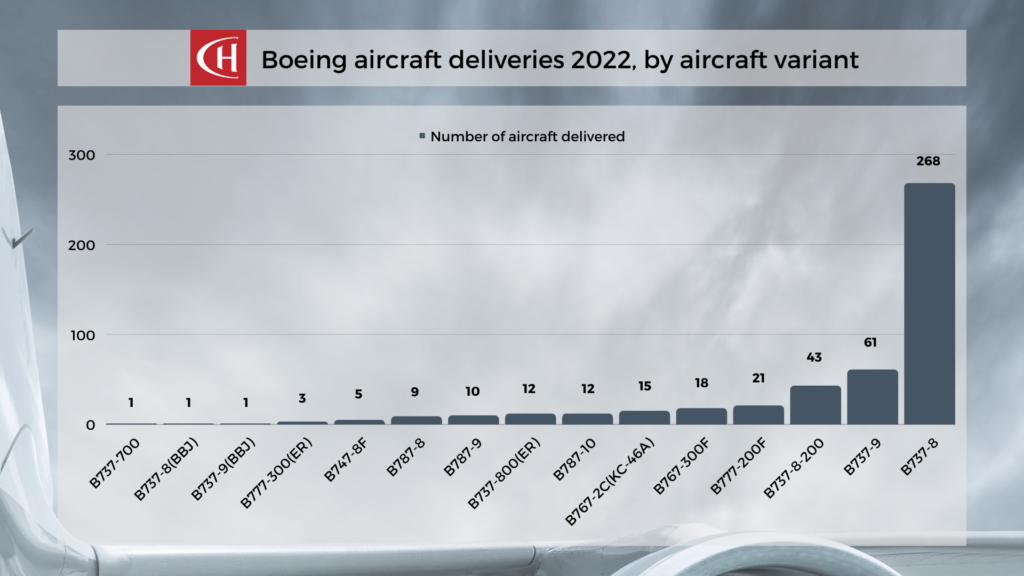

From Boeing’s perspective, 268 out of the 480 aircraft delivered in 2022 were B737-8s. Looking at the averaged production line output for the B737 family, we have a monthly theoretical value of 31 aircraft. Considering their initial efforts to deliver 500 737 aircraft in total by 2022 (41 per month), this indicates a 24% shortfall in monthly 737 deliveries. Whilst the B787 production problems are apparently solved, delivery numbers still need to pick up. Looking at the backlog, we will see a strong recovery in 2023 with the potential to close the gap in aircraft deliveries to Airbus even further.

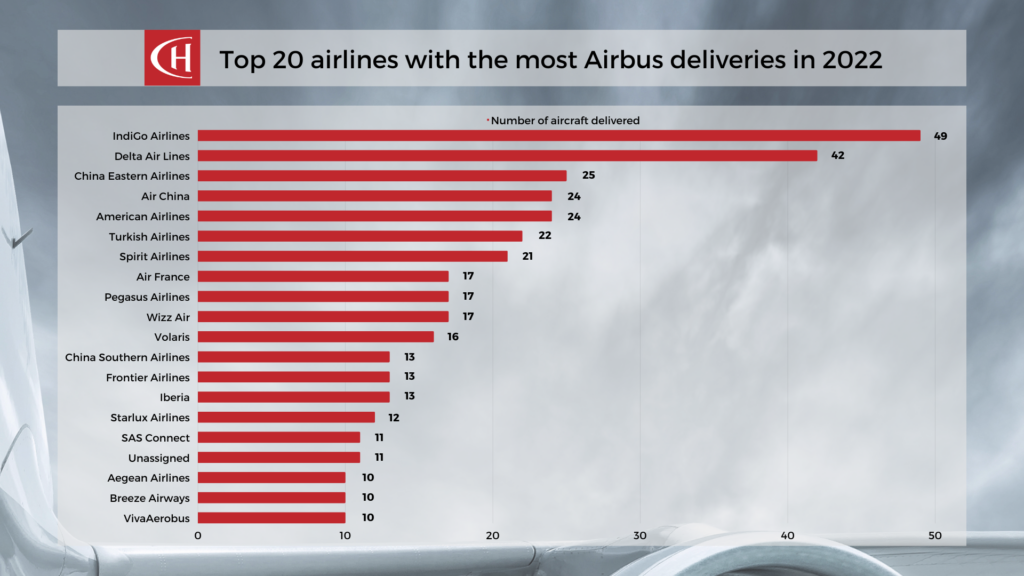

Airbus delivered most of its aircraft in 2022 to IndiGo Airlines – in total, 49 aircraft. Of these 49, there were 23 A320-300Ns and 26 A321-200NXs.

Following IndiGo Airlines were Delta Air Lines, which received 42 aircraft, China Eastern Airlines, with 25 aircraft received; and Air China and American Airlines, both receiving 24 aircraft.

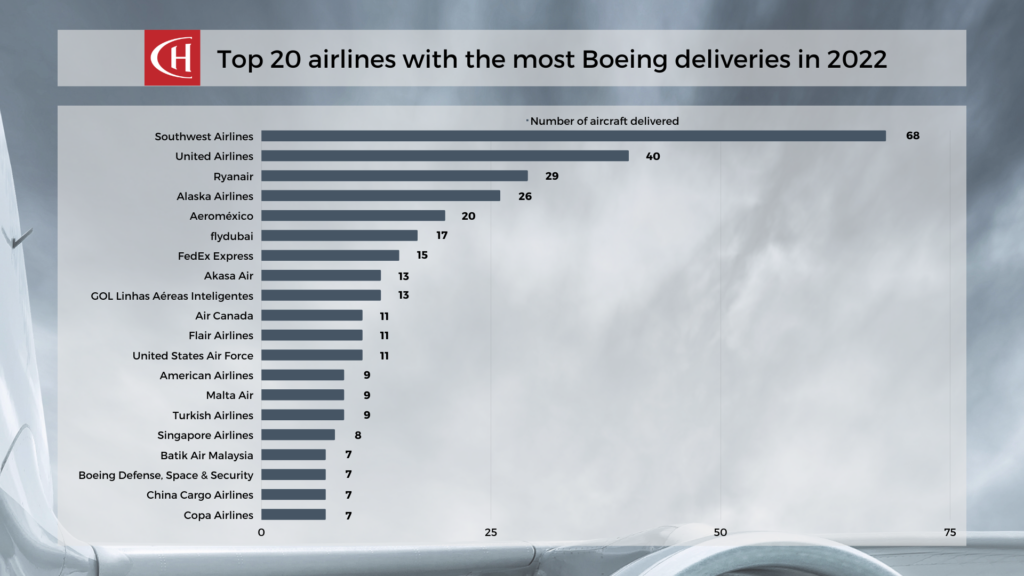

Boeing delivered most of the 480 aircraft in 2022 to Southwest Airlines – 68 of them, all B737-8s. Ryanair Group received 43 (Malta Air – 9, Buzz (Poland) – 5) all of which were B737-8-200s, United Airlines received 40 aircraft (B737-8, B737-9, and B787-10), and Alaska Airlines received 26 (B737-9).

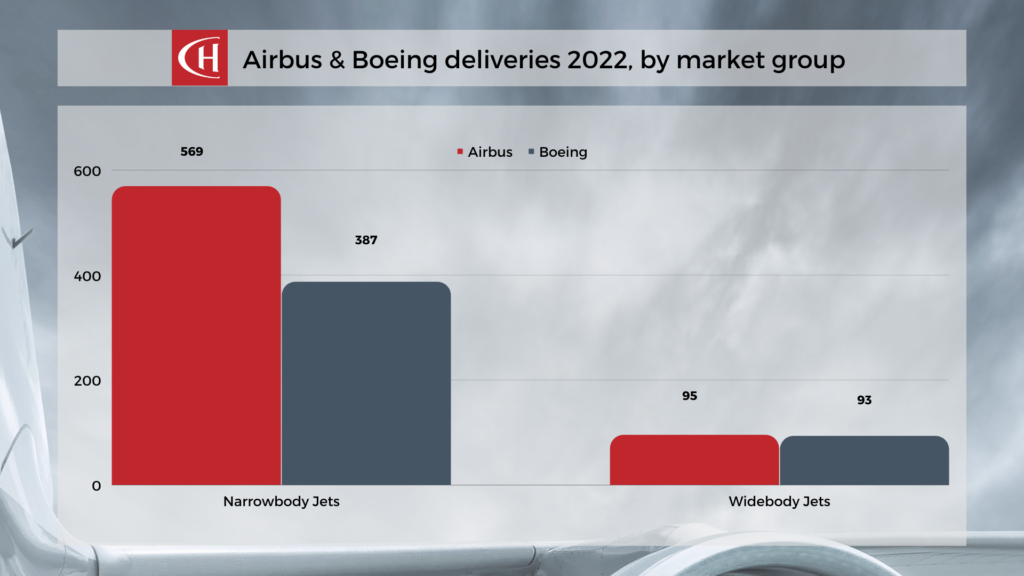

Narrowbodies remain the most popular market group, with 569 Airbus narrowbody aircraft delivered and 387 Boeing narrowbodies delivered. Widebody aircraft are second in demand, with Airbus delivering two more than Boeing in 2022.

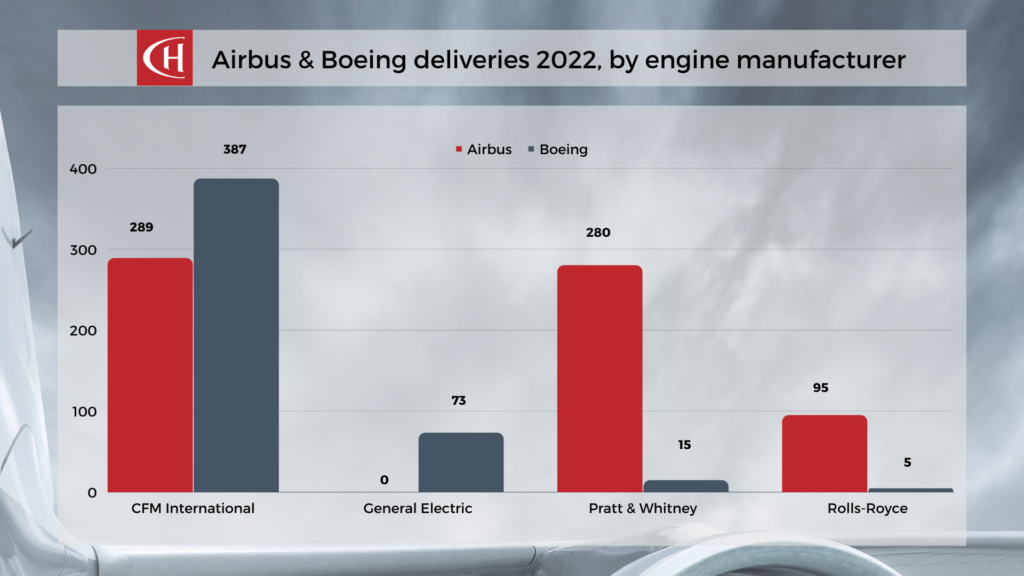

CFM International is the most prominent engine manufacturer, powering a total of 676 aircraft (387 Boeing and 289 Airbus) with 1352* of their engines. Pratt & Whitney follows in second place, with 590* of their engines, equipping a total of 295 aircraft (280 Airbus and 15 Boeing). Rolls-Royce and General Electric engines power a smaller proportion of the delivered aircraft.

* The engines listed here are according to aircraft deliveries and do not include spare engines which might have been purchased.

It is good to see Boeing returning on its feet in 2022, as a duopoly is not ideal but much better than a monopoly. The beginning of 2023, however, marked the delivery of the last B747, the “Queen of the Sky”, to Atlas Air. Looking ahead into 2023, the main problems might be related to a disturbed supply chain delaying scheduled deliveries and forcing Airbus and Boeing to slow down production rates equally. Boeing has a rather big backlog of produced aircraft without an owner, which could be delivered on shorter notice. If it manages its delivery and certification program well, we could see a much tighter race for the crown of “delivery champion” in 2023.

Follow the ch-aviation blog and our LinkedIn page for more interesting analysis.